Reliance Asset Reconstruction Company Limited (RARC) is a fast-growing Securitisation and Reconstruction company, registered with the Reserve Bank of India (RBI), under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002.

Our principal business is to acquire non-performing financial assets from banks / financial institutions, manage them through restructuring, and resolve them in a time-bound manner through active interventions.

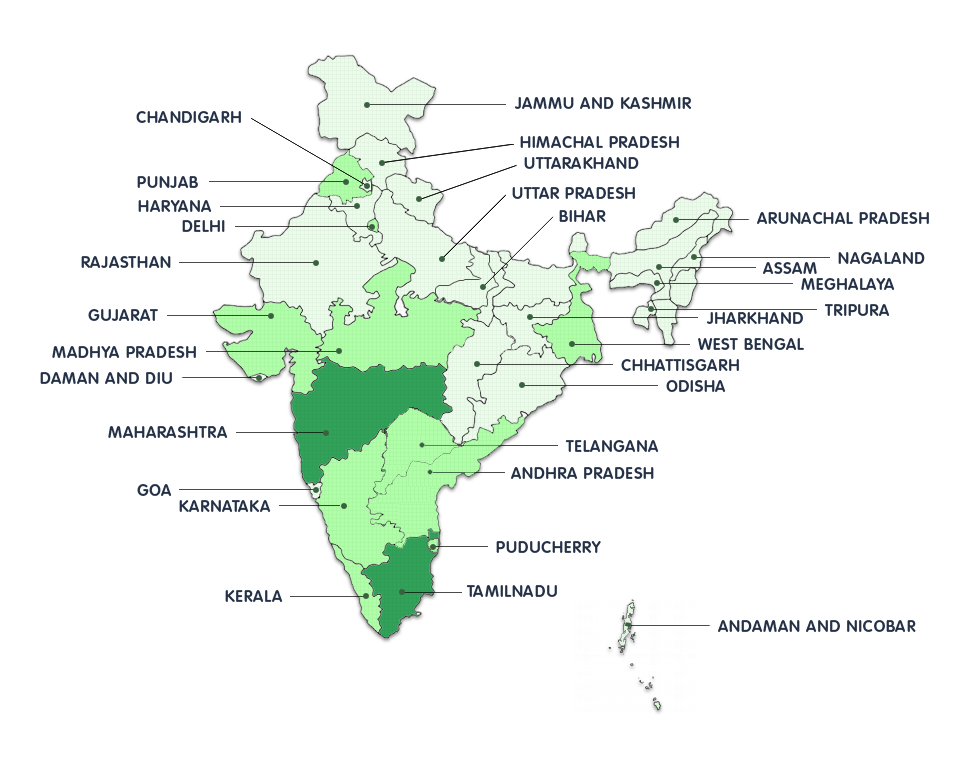

As on March 31, 2025, we manage a portfolio of 2,160 crore (earlier 2,329 crore crore) and 3,29,109 (earlier 3,81,117) customers across retail and SME segment. However, the portfolio concentration is high in retail segment (both secured and unsecured asset classes). We are present in all major towns and cities across the country, with a dominant retail presence in South and West.

The Asset Reconstruction industry has undergone a massive transformation over the last few years with the opening up of FDI, establishment of the insolvency code and expectations that ARCs will morph into actual turnaround specialists and, importantly, generate value for its shareholders.

Reliance Asset Reconstruction Company Limited is an active player in the country today within the overall Asset Reconstruction Company (ARC) space and amongst the top 2 in our chosen segment. We invest only if there is sufficient clarity on the turnaround or realisation of value relating to the asset or portfolio that is purchased. Our endeavour has been to grow responsibly and deliver shareholder value amidst the long adjudicating timelines which hopefully, is changed by the evolving Insolvency and Bankruptcy Code. The Government has shown commendable interest in resolving the non-performing loans and this with a more structured and evolving IBC, appears to be promising for the sector. However, whatever we do needs to be RoE accretive.

Executive Director & CEO

Provided no separate provision

of restructuring except through Mergers & Acquisitions (M&A)

or voluntary compromise

Assessed viability of industrial companies and referred them to High Court for liquidation if

they fail under

S.I.C.A. 1985.

Recommended setting up of ARCs

Introduced to empower Banks and FIs to recover stressed assets

To focus on recovery model or financial engineering

like recasting or

rescheduling debt

Introduced to reschedule debt repayments providing

relief to borrowers

From Reserve Bank of India in 2008 to act as a Securitisation or Reconstruction Company.

AUM greater than Rs. 500 crores

AUM greater than Rs. 1000 crores

Introduced to help creditors take

ownership of the company by

converting outstanding

loan to equity.

Introduced so that control of business remains in

borrower’s hand as

long as 50% of the

debt is “sustainable”

Provided a clear priority of claims structure for cash distribution in 180+90 day resolution time

AUM greater than Rs. 1500 crores

AUM greater than Rs. 2000 crores

AUM greater than Rs. 2200 crores

RARC has Operating Hubs in 7 locations and multiple SPOCs across the country to assist the Resolutions and Recovery Process.